Who is bankrupt in China?

Bankruptcy once was a vague term for Chinese society and Chinese people. 40 years ago, there were only Chinese state-own companies, the companies with no existing bankruptcy. Even though China accepts the marketing force after the 1978 Open and Reform policy, the bankruptcy law only covers enterprise legal persons. World Bank's survey found that there are more than half of the low- and middle-income counties all around the world did not establish a personal bankruptcy system. China was one of them. For a long time, individuals bankruptcy is invisible at law level in mainland China.

When the Personal Bankruptcy Ordinance of Shenzhen was officially issued in 2021, it is considered an important point of China's bankruptcy legislative history for see individuals' bankruptcy. Seeing individuals’ bankruptcy moving from invisible to invisible, I am particularly interested in what kind of people need to apply for personal bankruptcy in China. What are their profile looks like? Thus, I collect the data from the website of “Shenzhen Personal Bankruptcy Information Disclosure Platform” (深圳市个人破产信息公开平台), which is the governmental website to publish the bankruptcy statement to society, to make a deeper investigation of individual bankruptcy stories.

On this website, the court publishes the short but informative applicant's bankruptcy statement to society to show transparency. Some of them include the process of how and why they became broke. I used a web scraper to collect 103 individual bankruptcy statements in total, and then I did the data cleaning and some manual coding. All the data processes will be illustrated in another blog. Here are some findings in the dataset.

Middle-age Male broke

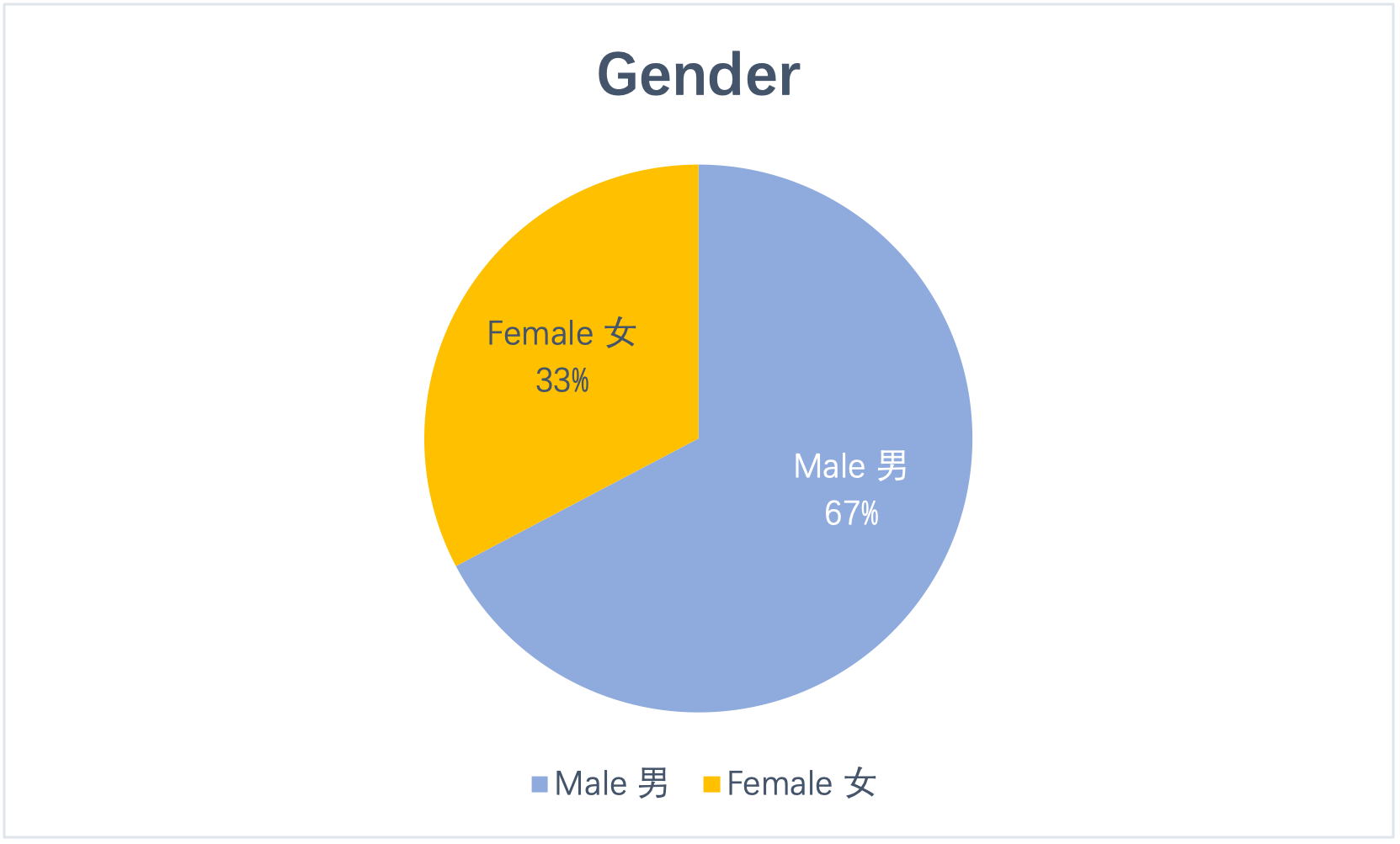

Gender shows a big difference. Male is easier to be pushed than female. Among bankrupts, 67% is male while female accounts for 33%. This matches research in Singapore, which shows the bankruptcy of males is two times that of females. One explanation is culture. Females are more aversion to risks than males.

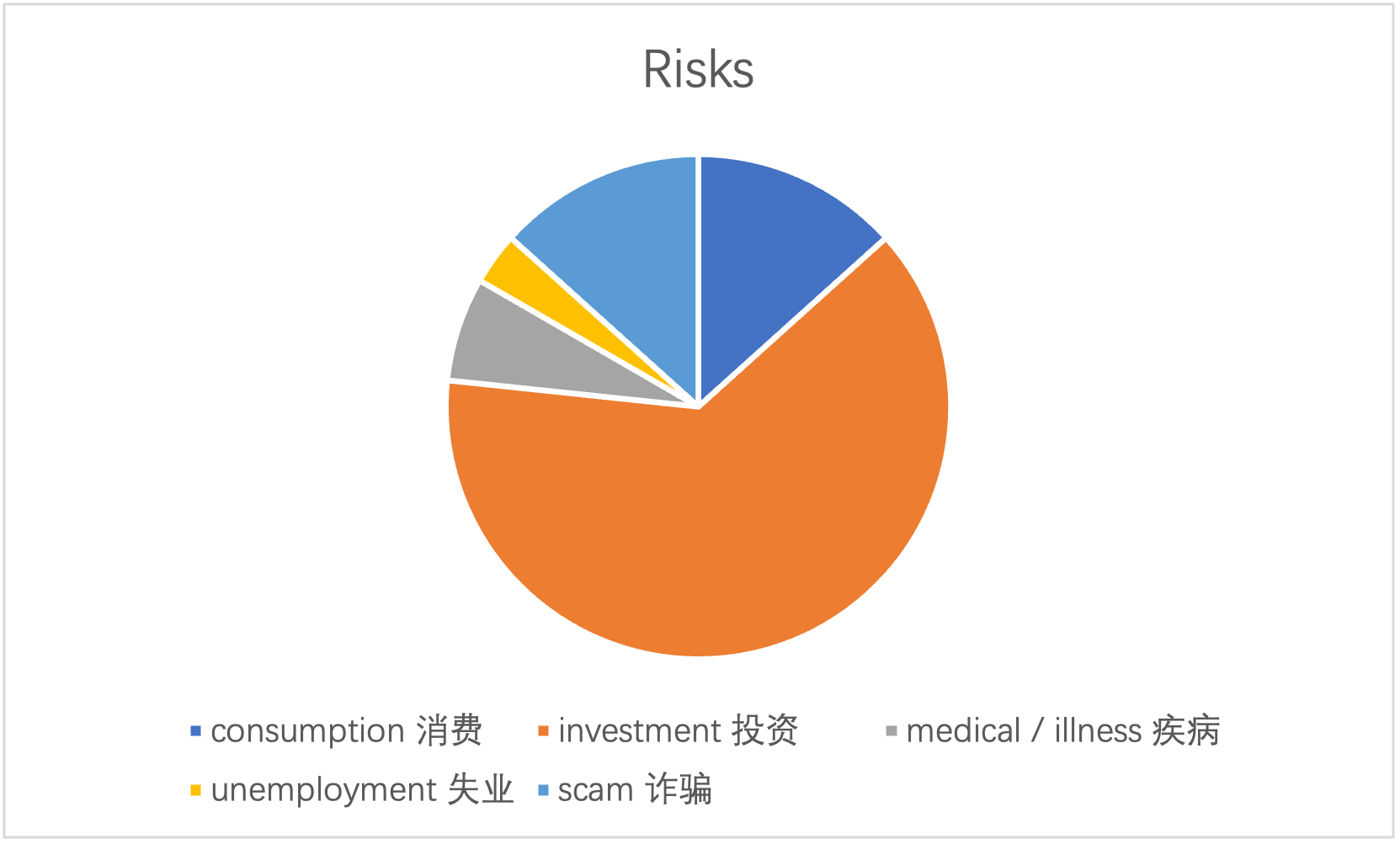

It seems to make sense. When applying the reported risks, around 75% of females became broke resulting from scams or consumption, without investment failure. But this number is extremely high for male bankrupt risks, which is approaching 83%. Investment is considered a high-risk financial decision. In other words, the male is more likely to make high-risk finical decisions.

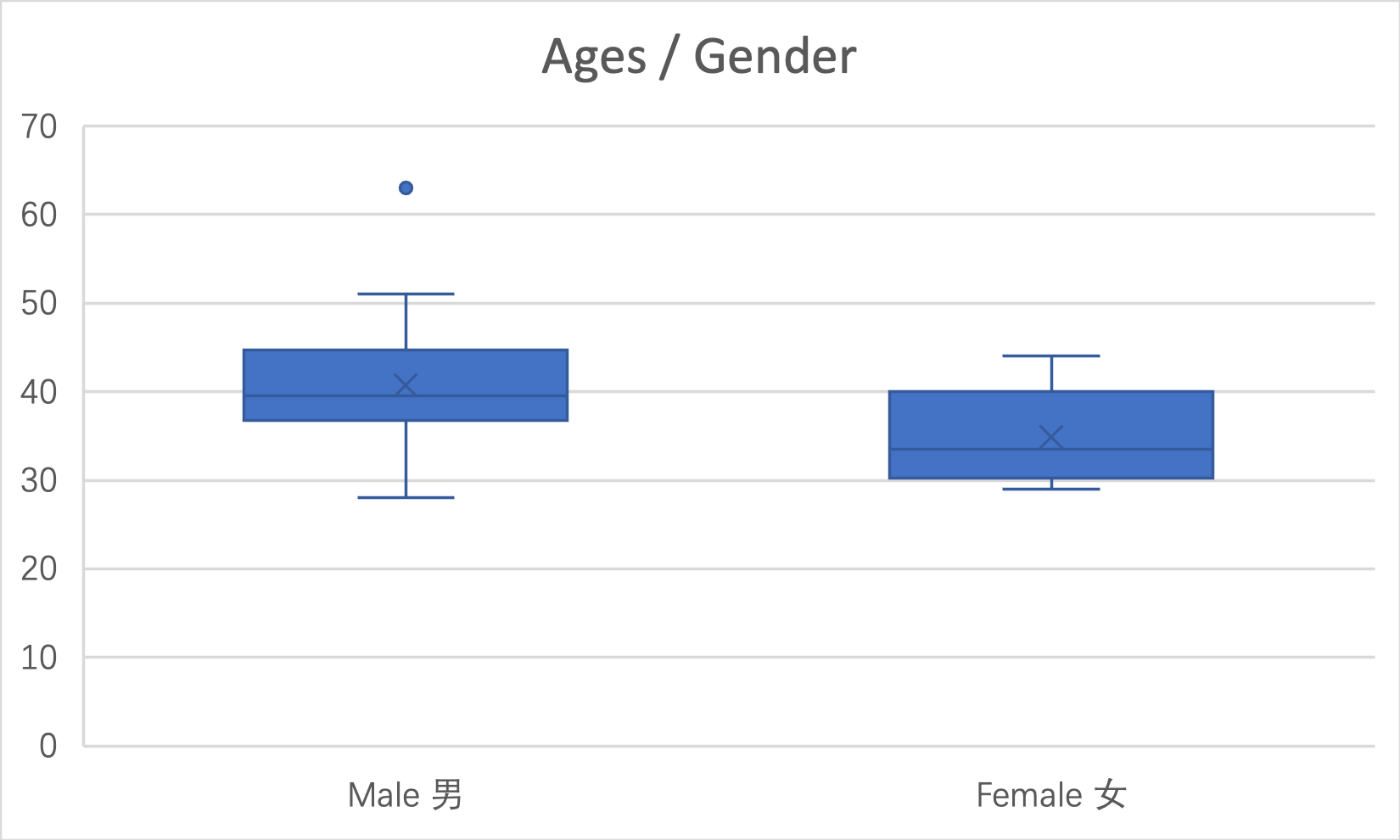

Then I move to an important element of the profile. Age. It is interesting to see both males and females are mainly around 30-40 years old. The range of male ages are older than female. Basically, all the broke people are in their middle age, from 30-40 years old.

Fail investment & Multiple risks with bankruptcy

From the detailed statement, the most common reason why they are bankrupt is the failure of the investment. This is quite unique. Because of reviewing research in western society, people are more easily becoming bankrupt because of bad economic conditions, like credit card debt. According to the book "The Fragile Middle Class: Americans in Debt", most American is one crisis away from bankruptcy. Because of their existing high credit card debt, one of the shocks like job-related reasons, credit cards, sickness and injury, divorce and family problems, or mortgage debt could push them into bankruptcy.

But the thing does not match in Chinese data. More than 56% of the bankruptcy statement show that they did not face credit card debt. On the contrary, these people suffer more than one crisis before they were pushed into bankruptcy. In other words, multiple risks lead to bankruptcy. Via analyzing the bankruptcy reasons, the highest frequency of bankruptcy is an investment, followed by consumption.

Wealthy middle-class broke

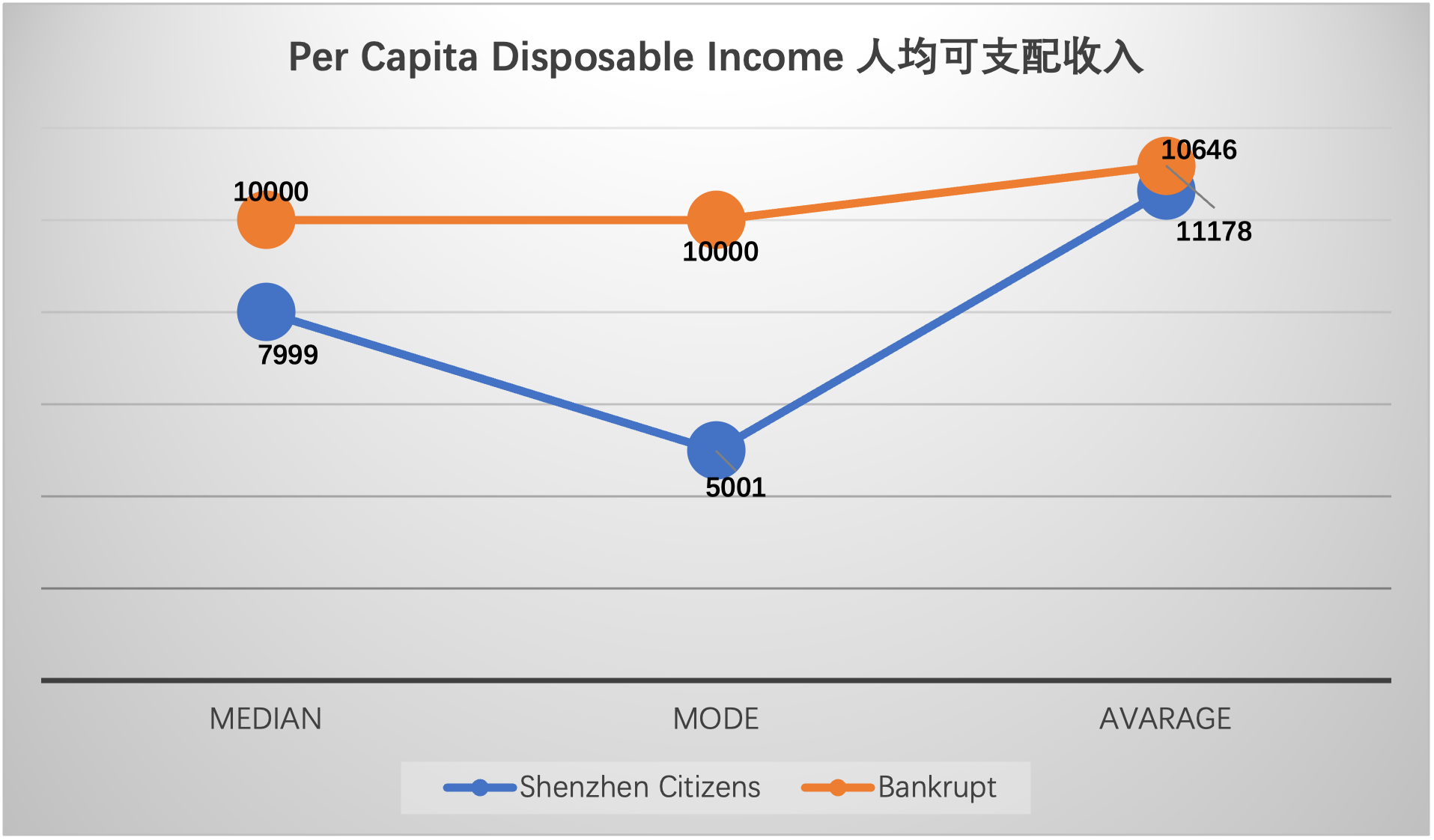

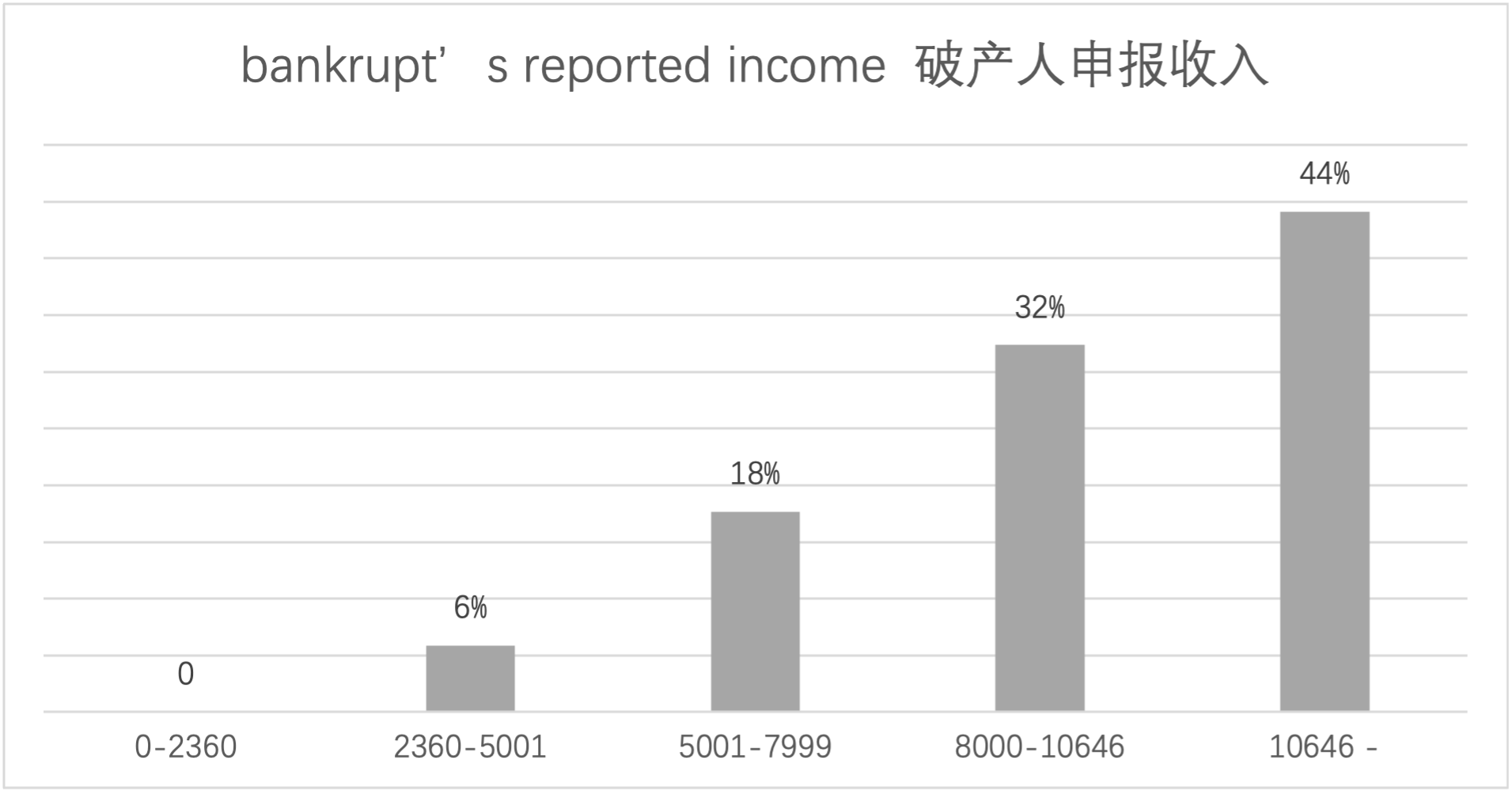

According to the official data, the median income of Shenzhen is 7999 renminbi (RMB) per month, while the mode income is 5001 RMB, and the average is 10646. (*In statistics, the median is the one in the middle of a set of data arranged in order. Compared with the average salary, the median is more reflective of the real salary level.) Bankrupt data show that mean and mode income of bankrupt are much higher than ordinary Shenzhen citizens.

The average income of Shenzhen is considered as more than the third quartile value, which means if taking more than 10646 per month, this income exceeds 75% of Shenzhen residents. The monthly minimum wage in Shenzhen is 2360 RMB. When looking into the bankrupt data, both of the median and mode of the bankrupt’s reported income exceed the common figures. When applying 2360, 5001, 7999, and 10646 as the scales to measure their income, the results show that the income of most of the bankrupt applicants is above 75% of Shenzhen residents.

Who is bankrupt?

If drawing a picture from the previous analysis, the popular profile of Shenzhen bankruptcy applicants is quite clear. This person is possibly a male and enjoys a superior income than normal citizens, which suggests he at least is a wealthy middle-class. His wealth allowed him to confront multiple risks until he was finally pushed into bankruptcy.

This unusual profile could be explained with the aims of personal bankruptcy law. The explanation is that current law rules mainly work as a trial extension of company bankruptcy law, to help individuals facing several liabilities for enterprise debts. It is a refill to save their social life the individuals and stop them run-away. So it explains why most applicants face the problem of investment failure.

But critically, it is no doubt that most applicants are the privileged group in Chinese society. It also matches the middle-class image of Chinese society, who is the man of substance in middle age, owning an abundance of income in society (*middle-class image from the book "The New Middle Class in China").

The only totally distinct story in all the data is a bankrupt story from a truck driver and his wife. The inland immigrants to Shenzhen, struggle with their small trucking business for a long time. And then their business, unfortunately, was destroyed because of strict China‘s Covid-19 policy, which also is a direct risk resulting in their broke. Their economic difficulties are also involved with the long-time illness bill for their parents' severe illness. They did not own any household, and the only valuable asset is their truck. Their monthly average income did not reach the mean income of Shenzhen citizens.

Personally, I prefer to say most of the bankruptcy statements on the website could be renamed as “Chinese middle-class bankruptcy”, besides this story. The couple's experience is more direct to the possible unfortunates faced by ordinary Chinese citizens.

/NOTE

The topic mainly came from a WeChat Chinese post - 《深圳个人破产信息网上,看完一百种普通人的失败》 “(On the Shenzhen personal bankruptcy information website, see one hundred kinds of ordinary human failures)”.

The small project was inspired by Dr Leah Herkinson. Sincerely thank her for all kind and informative sharings in COMM5780 Digital Practices in 2022 :)